Tradução e análise de palavras por inteligência artificial ChatGPT

Nesta página você pode obter uma análise detalhada de uma palavra ou frase, produzida usando a melhor tecnologia de inteligência artificial até o momento:

- como a palavra é usada

- frequência de uso

- é usado com mais frequência na fala oral ou escrita

- opções de tradução de palavras

- exemplos de uso (várias frases com tradução)

- etimologia

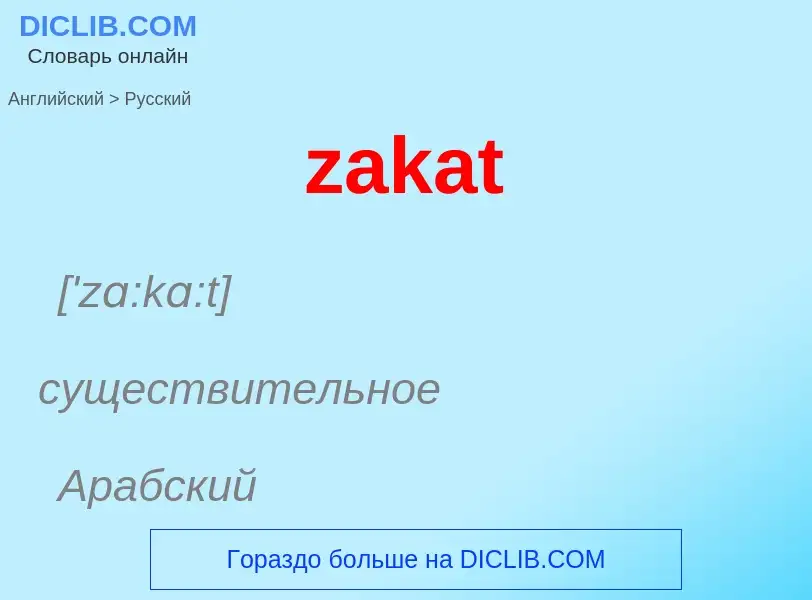

zakat - tradução para russo

['zɑ:kɑ:t]

существительное

Арабский

закат (религиозный налог у мусульман)

Definição

Wikipédia

Zakat (Arabic: زكاة; [zaˈkaːt], "that which purifies", also Zakat al-mal [zaˈkaːt alˈmaːl] زكاة المال, "zakat on wealth", or Zakah) is a form of almsgiving, often collected by the Muslim Ummah. It is considered in Islam as a religious obligation, and by Quranic ranking, is next after prayer (salat) in importance.

As one of the Five Pillars of Islam, zakat is a religious duty for all Muslims who meet the necessary criteria of wealth to help the needy. It is a mandatory charitable contribution, often considered to be a tax. The payment and disputes on zakat have played a major role in the history of Islam, notably during the Ridda wars.

Zakat on wealth is based on the value of all of one's possessions. It is customarily 2.5% (or 1⁄40) of a Muslim's total savings and wealth above a minimum amount known as nisab each lunar year, but Islamic scholars differ on how much nisab is and other aspects of zakat. According to Islamic doctrine, the collected amount should be paid to the poor and the needy, Zakat collectors, recent converts to Islam, those to be freed from slavery, those in debt, in the cause of Allah and to benefit the stranded traveller.

Today, in most Muslim-majority countries, zakat contributions are voluntary, while in Libya, Malaysia, Pakistan, Saudi Arabia, Sudan and Yemen, zakat is mandated and collected by the state (as of 2015).

Shias, unlike Sunnis, traditionally regarded zakat as a private action, and they give zakat to imam-sponsored rather than state-sponsored collectors, but it is also obligatory for them.

![Zakat [[donation box]] at [[Taipei Grand Mosque]] in [[Taipei]], Taiwan Zakat [[donation box]] at [[Taipei Grand Mosque]] in [[Taipei]], Taiwan](https://commons.wikimedia.org/wiki/Special:FilePath/Zakat Donation Box in Taipei Mosque 20190519.jpg?width=200)